Income tax slabs refer to the different tax rates imposed on various income brackets by the government. Here we discuss with you the tax rates applicable for the financial year 2023-24 (Assessment year 2024-25) under the new and old tax regimes.

While the Government has introduced new tax slabs for the new tax regime in the union budget 2023, the tax rates under the old regime are the same as that applicable for the previous year.

The new tax regime was introduced in Budget 2020 with 6 slabs, will now have 5 income tax slabs for individuals, senior citizens and HUF (Hindu Undivided Family). The basic exemption limit was also increased to Rs. 3 lakh from the earlier Rs. 2.5 lakh in the case of the new tax regime for FY 2023-24.

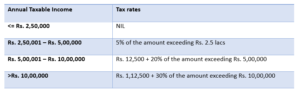

TAX RATES FOR INDIVIDUALS – OLD REGIME

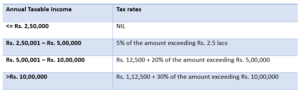

For Individuals below 60 years of age:

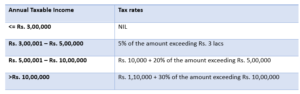

For Senior Citizens (aged 60 years or above but below 80 years):

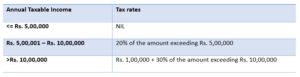

For Super Senior Citizens (aged 80 years or above):

TAX RATES NON RESIDENT INDIVIDUALS AND HUF:

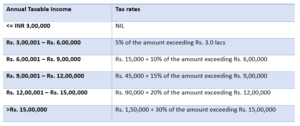

TAX RATES – NEW REGIME

The New tax regime is the default tax regime for individuals and HUF for Assessment year 2024-25. Further, the benefit of new tax regime has also extended to Association of Persons (AOP)/Body of Individuals (BOI) and Artificial Juridical Person (AJP) w.e.f. Assessment Year 2024-25. If one to opt-out from default new tax regime, he has to exercise the option under section 115BAC(6).

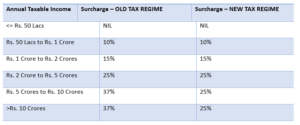

SURCHARGE

Surcharge is levied on the amount of income-tax at following rates if total income of an assessee exceeds specified limits:-

Note –

- The enhanced surcharge of 25% & 37%, as the case may be, is not levied, from income chargeable to tax under sections 111A, 112, 112A and 115AD. Hence, the maximum rate of surcharge on tax payable on such incomes shall be 15%

- The maximum rate of surcharge on tax payable on dividend income shall be 15%.

- Health and Education cess @ 4% is applicable on the total tax payable

- Rebate u/s 87A: Resident Individual whose Total Income is not more than ₹ 5,00,000 is also eligible for a Rebate of up to 100% of income tax or ₹ 12,500, whichever is less under the old tax regime.

- Rebate u/s 87A: Resident Individual whose Total Income is not more than ₹ 7,00,000 is also eligible for a Rebate of up to 100% of income tax or ₹ 25,000, whichever is less under the new tax regime.

Source

- https://incometaxindia.gov.in/news/finance-bill-2023-highlights.pdf

- https://economictimes.indiatimes.com/wealth/tax/new-income-tax-slabs-for-new-tax-regime-announced-in-budget-2023/articleshow/97508804.cms

- https://incometaxindia.gov.in/tutorials/2%20tax%20rates.pdf

Disclaimer: The information provided on this site is for informational purposes only and does not establish an attorney-client relationship. It is not a substitute for legal advice from a licensed professional in your state. We make no guarantees about the accuracy or completeness of the information and disclaim any liability for actions taken based on it. Use this information at your own risk, and consult with a qualified attorney for advice tailored to your specific situation.